Post-election hangover. What now happens to stock markets, and how can investors protect their investment portfolios

If, like me, you’re fed up with TV coverage of the election and a hung parliament, then there is some good news. Stock Markets did not fall off a cliff edge, and although the UK is experiencing some political turmoil, the rest of the world seems to be getting on with business as usual.

The current challenges facing the UK cannot be underestimated, but consider some of the issues we’ve faced over the last forty or fifty years. If you’re investing long-term, markets tend to be efficient and consider all available information. Long-term investors are rewarded for the additional risk they are taking by investing in Stocks and Bonds.

However, there are some things investors can do to help ensure if there is a fall in Stock Markets. They can help limit the downside impact of temporary falls in the value of their investments.

Don’t Panic

If you are investing for the long term, then you should expect stock markets to drop at some point. Fund managers see this as an opportunity to purchase stocks at a lower-than-normal price, hoping to make additional profit when normality returns.

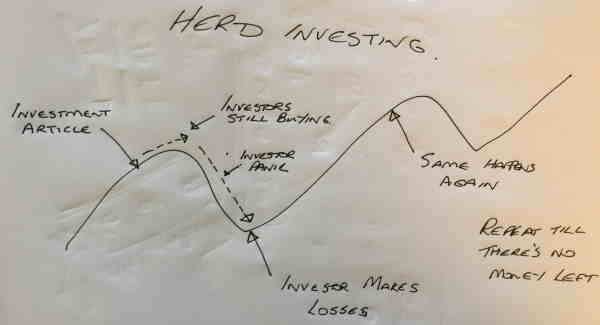

Don’t follow the herd.

How often have you read the financial press offering investing tips on the next big investment success? As markets are efficient, you’ve probably missed the boat if it’s in the paper. Investors who buy on these recommendations, whether it’s stock or investment funds, should be aware of herd investing.

The simple illustration below shows how this works and the long-term effect of doing this.

Are you taking too much or too little risk?

Financial Planners often ask their clients to complete a risk questionnaire to ensure that the client is not taking too much or too little risk. If you haven’t reviewed your portfolio or financial plan in some time, it might be worth asking your adviser to re-assess the risk you are taking with your investments.

Rebalance your Portfolio

One of the fundamental investment principles to controlling risk is to ensure your investment portfolio is re-balanced regularly. This might be carried out annually, half-yearly or quarterly. Our recent article called the importance of rebalancing your Investments describes why this is an important task. Rebalancing controls the split between your Stocks and Shares, Fixed Interest, Gilts, Property and Cash. The aim is to ensure your portfolio does not become riskier over the long term.

Your financial Planner should have included the re-balancing process and how they implement it in their investment policy statement.

Use your annual allowances.

The UK Government want to encourage people to save for the future, such as retirement. Each tax year, investors will have certain allowances they can use, i.e. tax breaks. Examples of the allowances are:

- Individual Savings Accounts

- Pension Planning

- Capital Gains Tax

- Dividend allowance

- Interest allowance

Investors should always use their allowances first if they consider adding to or starting new investments or pensions.

For the current tax year 2017/18, the ISA allowance has increased to £20,000 per person. The maximum annual allowance for pension contributions is £40,000, however this might be reduced if you have taken benefits from any pensions previously or if you are a high earner.

Apart from ISAS and pensions, Investors should also use their annual capital gains tax allowance if they have profits on investments subject to CGT. The current allowance is £11,300 for the 2017/18 tax year.

There is also a £5000 annual allowance in relation to dividends.

Regular Savings

Many savers combine saving each month with investing a lump sum into pensions or ISASs. By investing each month, you could possibly benefit from pound cost averaging, whereby if the price of the investment falls, you buy in at a lower price, hoping to benefit from price increases in the future.

Further, Help

If you have any questions about Investment Advice or any other article we have written, please contact us. You can use either the contact form or alternatively call us on 01454 321511.